The career path of every MBA graduate after they have completed their studies is as unique and individual as each person. There are no ‘set’ paths and one of the most valuable aspects of an MBA is the opportunities it opens up.

However, within this broad spectrum of opportunity two post-MBA career paths have become fairly well trodden — the entrepreneurial small business person and the consultant.

If you are contemplating and MBA or already deep into one it is worth considering which path you will take after you graduate. Financial compensation will be an important part of this decision. So which one pays better?

Harvard Business School Professor’s Richard Ruback and Royce Yudkoff attempted to answer the question in a recent study for Harvard Business Review.

They compared compensation for MBAs who move into entrepreneurship-through-acquisition (EtA) — in which individuals purchase an existing small business to own and run themselves — with careers like consulting, investment banking and private equity.

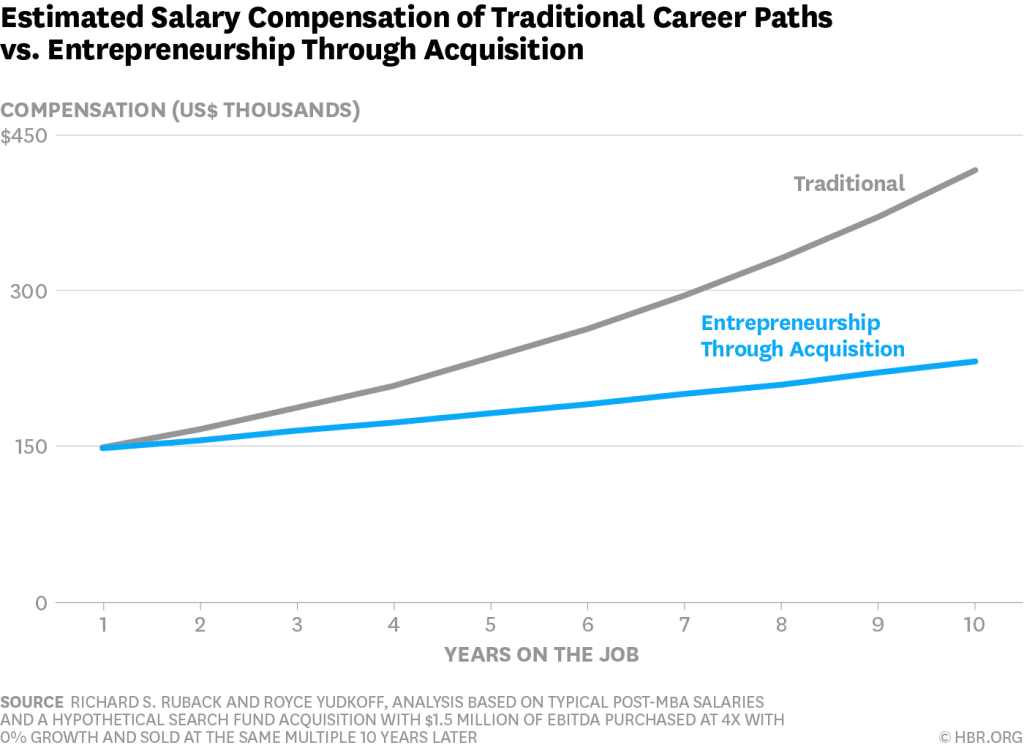

“We’ll assume the salary in a traditional post-MBA job grows at a 12% compound annual growth rate (CAGR) so that it more than triples in the first 10 years, which is in line with post-MBA salary surveys we’ve done here at the Harvard Business School,” the report said.

“We’ll also assume the cash compensation for a new CEO of a small business starts off at the average post-MBA salary, and its growth is generally tied to the performance of the company — both of which are typical from our experience as board members of these types of companies.

“Because we generally argue that those searching for a small business to buy should target slow-growing dull businesses, we’ve put this at 5% per year.”

The chart below shows that over the first 10 years of employment, the cash compensation from the traditional job dominates.

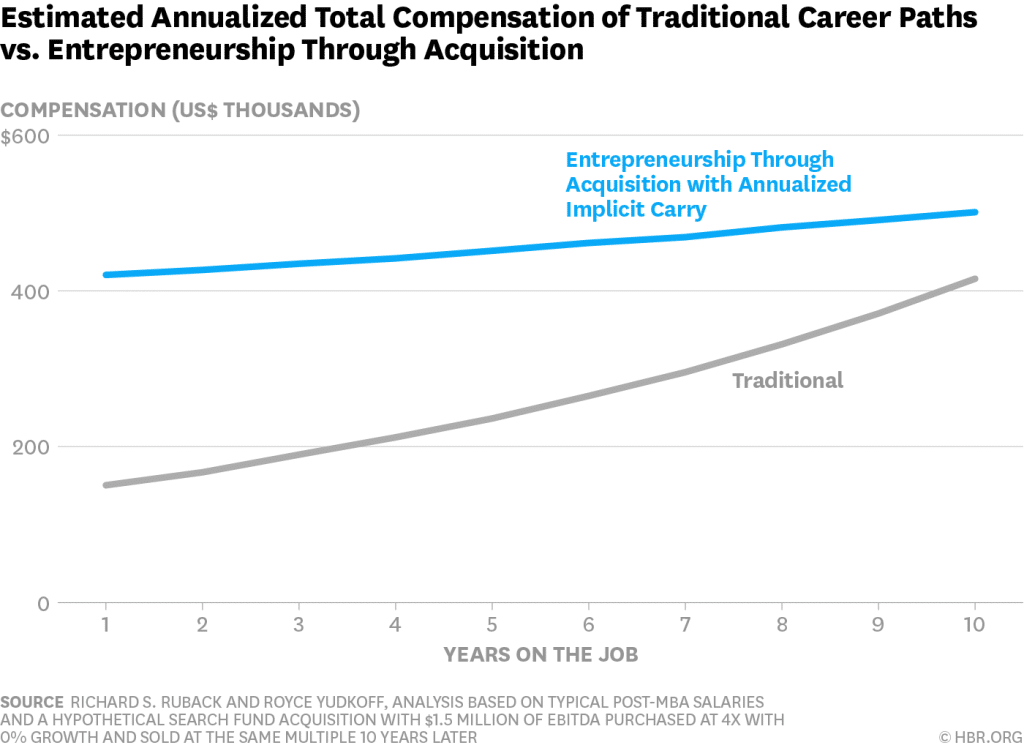

However, Professors Ruback and Yudkoff argue that annual cash compensation only tells part of the story because the owner of the business also has the opportunity to earn cash flows (profits/dividends/distributions) from their ownership of the business.

Add these cash flows this to the cash salary and the entrepreneurship through acquisition path dominates the traditional post-MBA career path, as shown in the chart below.

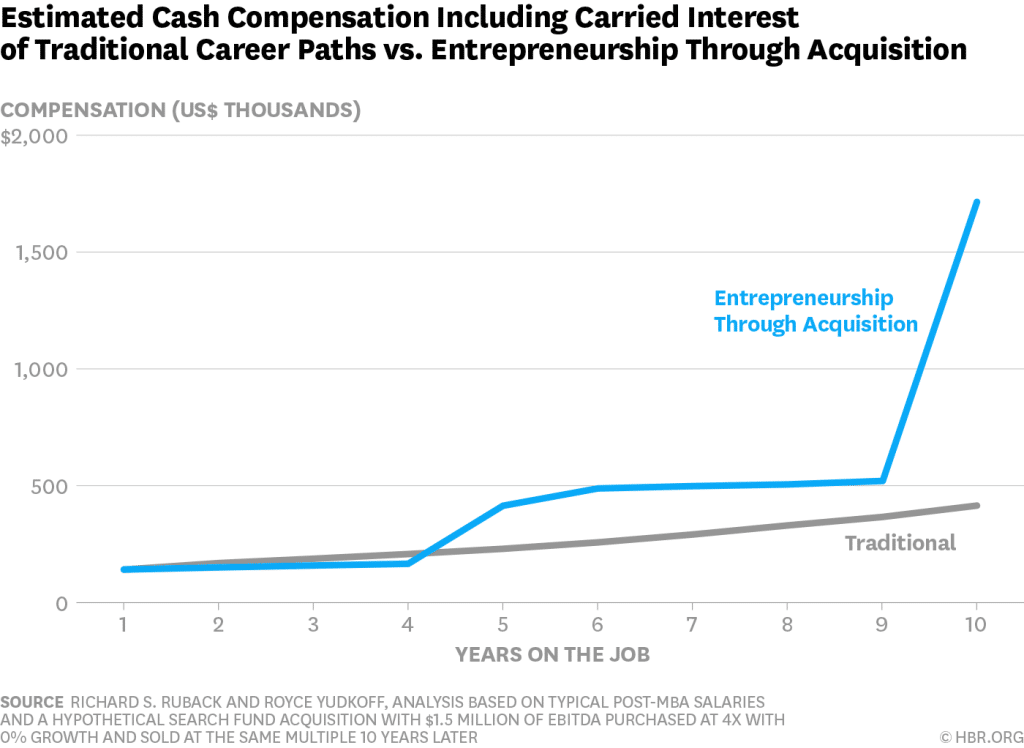

Furthermore, the business-owning MBA also has the opportunity to receive a significant boost to compensation if they are able to increase the value of the business and engineer a successful exit.

“The advantage to the traditional path in the early years is very much offset by the impressive EtA cash flows that occur once the carry starts getting paid and even more so upon exit,” the Professors stated.

Here is the revised comparison:

Professors Ruback and Yudkoff warn against using the model to show that one career path dominates another.

“To us, it shows that the compensation is reasonably similar across the two paths; certainly individual variations in experiences will dominate any systematic differences. With money out of the calculus, and the general assessment from MBA graduates that the non-pecuniary aspects of being a small business CEO dominate those of more traditional careers, we imagine that more graduating MBA students will choose the EtA path,” they said.

“Of course, being a small firm CEO doesn’t appeal to everyone so the decision turns, as we think it should, on whether you appreciate and will thrive in a small business environment.”

The original article is available here.