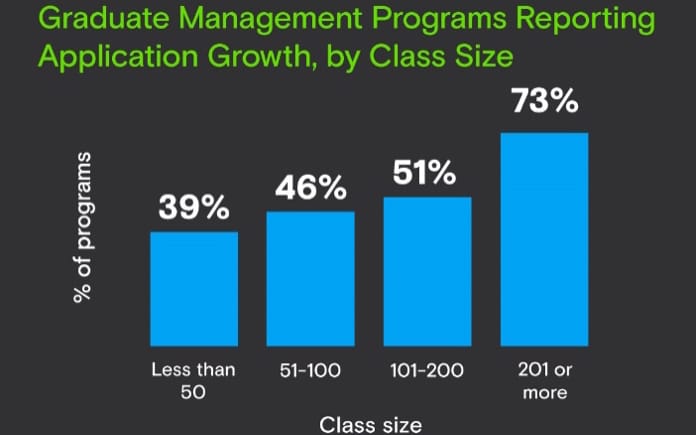

Business schools around the globe are experiencing a shifting demand as business students favour larger classes over smaller, more intimate programs.

According to a survey conducted by the Graduate Management Admission Council (GMAC), nearly three in four – or 73% – graduate business programs with 201 or more class seats report increased application volumes this year, compared to 39% of the smallest programs (50 or fewer class seats).

GMAC president and CEO Sangeet Chowfla attributed this trend in demand for bigger programs to prestige and brand recognition.

“While non-U.S. programs are thriving, a strong economy and a disruptive political climate are likely contributing to the downward trend in application volumes among smaller U.S. programs this year.”

Regardless of class size, a majority of programs in Europe, Canada, East and Southeast Asia, and India report growing volumes in 2017, while fewer than half the programs in the United States have grown, with the exception of part-time lockstep MBA and Master in Data Analytics programs.

GMAC conducted its 18th annual Application Trends Survey from early June to mid-July 2017. The survey findings were based on a record number of responses from 351 business schools and faculties located in 40 countries representing 965 graduate management programs, including MBA, non-MBA business master’s, and doctoral-level programs.

Participating programs received a combined total of 466,176 applications during the 2017 application cycle. Ninety-two percent of all participating programs report that the applicants this year are similarly or more academically qualified than candidates last year.

GMAC’s survey also suggested that the current political climate has impacted international application volumes. They found programs in Europe and Canada were about twice as likely to report growth in international applicants compared with the US across all program types, just 32% of US programs report growing international application volumes in 2017 vs. 49% in 2016. Despite the Brexit vote, about two-thirds of programs in the United Kingdom have seen international demand grow.

Overall, the 2017 report findings show that international applicants represent 57% of US application volumes, 70% of Canadian volume, 89% of European volume, 20% of East and southeast Asian volume, and less than one percent of Indian volume.

The results of the GMAC survey revealed that women were increasing their representation in the graduate business school pipeline. Among MBA programs women represented 39% of applications, up from 33% in 2013. More MBA programs report growth in female applicants (44%) compared with business master’s (39%), whereas the growth rate is similar for men — 40% for MBA and 39% for business master’s.

Additional Key Findings

- Overall volume to the general part-time MBA program category has been stagnant or on the decline since the Great Recession. Part-time lockstep programs — in which students proceed through a classroom-based program as a group — have seen stronger application volumes than part-time self-paced programs, in which students set their own schedule in a flexible format. Among US part-time MBA programs, 54% of lockstep programs report increased volume this year, compared with just 34% of self-paced programs.

- Most graduate business programs expect to see employer sponsorship remain stable. About half (52%) of part-time, self-paced students are expected to receive employer support, as are 40% of executive MBA and 39% of part-time lock-step MBA students.

- The level of experience that the applicant brings to the graduate business program has remained relatively consistent in 2017 compared with five years ago. For example, the majority of full-time MBA applicants have between three and 10 years of experience; the majority of executive MBA applicants have 10 or more years of experience; and most online MBA applicants have six or more years of experience.

- Among business master’s programs, applicants tend to have less than one year of work experience; the exception is the Master in Data Analytics candidate who tends to have more experience.