Australian MBA graduates looking for support and financial backing to acquire and grow an existing business are being urged to consider partnering with a search fund as the niche asset class looks to target opportunities in the local market.

While a relatively new concept in Australia, search funds have become increasingly popular in recent years in the United States as awareness of their return profile grows.

According to research by Stanford Graduate School of Business from 1984 through 2019, at least $US1.4 billion of equity capital was invested in traditional search funds and their acquired companies, generating, in total, approximately $US6.9 billion of equity value for investors and an estimated $US1.8 billion for entrepreneurs (searchers) so far.

The term “search fund” originated at Harvard Business School in 1984, was popularised at Stanford GSB in the following ten years and spread steadily to business schools and private investors worldwide.

A search fund is a niche private equity vehicle that brings together an entrepreneur with a team of experienced and well-financed investors, all with the sole aim of buying and operating a single small to medium enterprise with revenues of between $5 million and $50 million.

The funds provide entrepreneurs with access to capital and mentoring while providing business owners with an exit strategy.

The concept is being rolled out in Australia by Jake Nicholson, the Managing Director of SMEVentures, an accelerator for search fund entrepreneurs. A former search fund entrepreneur, he was also employee #1 at Search Fund Accelerator in the United States, the world’s first accelerator of search funds.

In addition, Jake teaches entrepreneurship through acquisition at INSEAD, from where he received his MBA and currently serves as entrepreneur-in-residence.

Mr Nicholson said the company was actively seeking out entrepreneurs (searchers) in Australia and strongly preferred people with an MBA.

“In most traditional private equity buyouts, the buyer incentivises the current CEO and management team to stick around for a period. Then, when appropriate, the buyer may source a new CEO or management team to replace the legacy team,” he said.

“Search funds, by contrast, start with the management solution (the searcher) before even identifying the target company. Indeed, it is the searcher who is responsible for sourcing the buyout opportunity.

“Even in PE firms with an entrepreneur-in-residence program, the EiR may do some sourcing, but the firm’s business development resources typically drive the bulk of the sourcing effort.

“The concept of giving the future CEO the entire responsibility of sourcing the buyout opportunity is pretty unique to the search fund model.

The search fund model has been wildly successful, with the Stanford research showing the aggregate pre-tax internal rate of return for investors was 32.6% through the end of 2019, and the return on invested capital was 5.5x.

Searchers typically come from the ranks of business schools, with the Stanford research showing that 84% of searchers have an MBA. The number of searchers launching a fund within three years of business school graduation was 62%, and the median age of a searcher was 32.

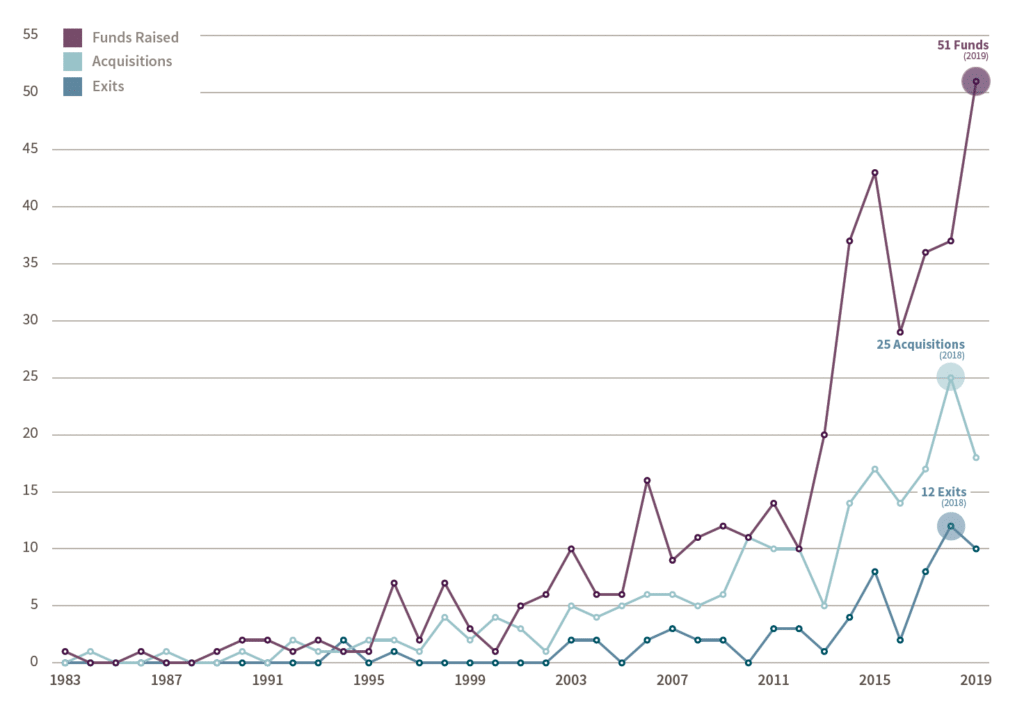

SEARCH FUND ACTIVITY (UNITED STATES) BY YEAR

Mr Nicholson said the quality of searchers was the most critical factor in the success of a search fund investment, and MBAs typically had the right experience, motivation, and broad-based education.

“Top-tier MBAs are more likely to join large brand-name firms, and relatively few join SMEs, especially in the unsexy industries of which the search fund model is so fond. Therefore, there may be opportunities to bring ideas and tools to an SME that have not been previously implemented at that SME or perhaps even in the industry,” he said.

“The seller has often been running the business since she was of a similar age to the searcher. The seller can therefore identify with the searcher, and the two can build a special relationship. This relationship can both increase the probability of a successful closing and support a successful transition post-acquisition.

“The relatively young searcher is more energetic, hungrier, and less tired than the more seasoned operator. She is also sometimes more willing to throw herself fully into the business.”